Contents:

The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575. When entering net income, it should be written in the column with the lower total. You then add together the $5,575 and $4,665 to get a total of $10,240. If you review the income statement, you see that net income is in fact $4,665.

Usually, year-end adjusting entries include the following items. It’s always going to come out the same as long as your debits and your credits are the same. Once the posting is complete and the new balances have been calculated, we prepare the adjusted trial balance.

- The adjusted trial balance is generally completed separately from the original trial balance as a check to make certain the adjusting entries made comply with the accounting equation.

- The accounting cycle is a multi-step process designed to convert all of your company’s raw financial information into usable financial statements.

- If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately.

- If you check the adjusted trial balance for Printing Plus, you will see the same equal balance is present.

Step 5 − To comply with accrual rules of accounting, entries are adjusted accordingly . Searching for and fixing these errors is called making correcting entries. Double-entry accounting (or double-entry bookkeeping) tracks where your money comes from and where it’s going.

Once you’ve double checked that you’ve recorded your debit and credit entries transactions properly and confirmed the account totals are correct, it’s time to make adjusting entries. An unadjusted trial balance is what you get when you calculate account balances for each individual account in your books over a particular period of time. Since you’re making two entries, be sure to double-check the debits and credits don’t apply to the wrong account. This can result in a balance increasing when it should be decreasing leaving you with incorrect numbers at the end of an accounting period. Every good account should keep eye on every unadjusted financial item. If he passes the journal entry of every adjustment and shows its effect on adjusted trial balance, it is good for fair practical view of financial statements.

Welcome to Accounting Education

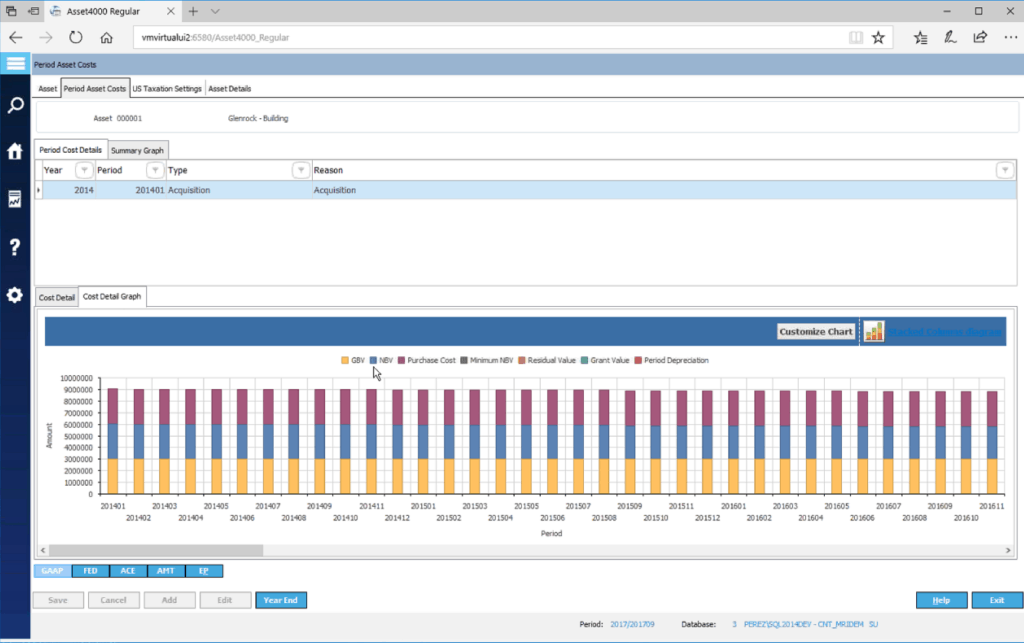

The second two columns show the adjustments that have been made to a few accounts. The trial balance is a report that lists all the ledger account balances as of a certain date. The adjusted trial balance is a report that lists all the ledger account balances as of a certain date and includes the adjustment amounts that have been added to the accounts. Both the unadjusted trial balance and the adjusted trial balance play an important role in ensuring that all of your accounts are in balance and financial statements will reflect the most accurate totals. In addition, your adjusted trial balance is used to prepare your closing entries, which is the next step in the accounting cycle. Preparing an adjusted trial balance is the fifth step in theaccounting cycleand is the last step beforefinancial statements can be produced.

Marketing Consulting Service Inc. adjusts its ledger accounts at the end of each month. The unadjusted trial balance on December 31, 2015 and adjusting entries for the month of December are given below. The second method is simple and fast but less systematic and is usually used by small companies where only a few adjusting entries are found at the end of accounting period. In this method, the adjusting entries are directly incorporated to the unadjusted trial balance to convert it to an adjusted trial balance. If you look in the balance sheet columns, we do have the new, up-to-date retained earnings, but it is spread out through two numbers.

Unit 4: Completion of the Accounting Cycle

In our detailed accounting cycle, we just finished step 5 preparing adjusting journal entries. We will use the same method of posting (ledger card or T-accounts) we used for step 3 as we are just updating the balances. Remember, you do not change your journal entries for posting — if you debit in an entry you debit when you post. After we post the adjusting entries, it is necessary to check our work and prepare an adjusted trial balance. While the definition of the document is relatively straightforward, you’re probably thinking – what is the purpose of the adjusted trial balance?

Beginner’s Guide to the Accounting Cycle – business.com – Business.com

Beginner’s Guide to the Accounting Cycle – business.com.

Posted: Wed, 16 Feb 2022 16:23:46 GMT [source]

Companies prepare the adjusted trial balance through a process. Now the adjustment entry for an accruing one-month wage would be passed. This will increase the wage expense and create a new liability of wages payable. So I know my adjusted trial balance is right because my debits and my credits are equal.

Company

Before preparing financial statements, verify that the accounts balance — that the amounts in the debit accounts equal the amounts in the credit accounts. List all of the accounts, including assets, liabilities, revenue, expenses and equity — or ownership — accounts. The current balance for each account is entered into the corresponding debit or credit column. Each column is then totaled; if the two columns do not have equal amounts, something was entered incorrectly. The adjusted trial balance is crucial in allowing companies to prepare financial statements.

- The adjusting entries for the first 11 months of the year 2015 have already been made.

- The above are the most common errors that occur due to which the trial balance does not balance.

- Journal entries are usually posted to the ledger on a continuous basis, as soon as business transactions occur, to make sure that the company’s books are always up to date.

- After that is the case, the unadjusted trial balance is used by an accountant to indicate the necessary adjusting entries and the resulting adjusted balances.

- To prepare the financial statements, a company will look at the adjusted trial balance for account information.

The above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are made. Remember not to confuse adjusting entries with closing entries. An adjusted trial balance is formatted exactly like an unadjusted trial balance. Three columns are used to display the account names, debits, and credits with the debit balances listed in the left column and the credit balances are listed on the right. The adjusting entries are shown in a separate column, but in aggregate for each account; thus, it may be difficult to discern which specific journal entries impact each account.

What are the three trial balances?

No more time spent getting your reporting up to date, just time using those reports to understand your business. The accounting cycle is a multi-step process designed to convert all of your company’s raw financial information into usable financial statements. To exemplify the procedure of preparing an adjusted trial balance, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. To simplify the procedure, we shall use the second method in our example. The balance sheet is classifying the accounts by type of accounts, assets and contra assets, liabilities, and equity.

An https://1investing.in/ is a listing of the ending balances in all accounts after adjusting entries have been prepared. Once a book is balanced, an adjusted trial balance can be completed. This trial balance has the final balances in all the accounts, and it is used to prepare the financial statements. The post-closing trial balance shows the balances after the closing entries have been completed.

How to Prepare Adjusted Trial Balance?

An adjusted trial balance will have three columns and will look just like an unadjusted trial balance. Like an unadjusted trial balance, it will have accounts listed in order of either their account numbers or in the order they appear on the balance sheet. Ensuring the adjusted trial balance report is presented in a clear, organized way will make it easier for you when it comes to preparing your financial statements at the end of the year. There are many types of software to explore, which can be used to prepare an adjusted trial balance. You can produce it using ExCel, AccountEdge Pro, QuickBooks Desktop and Sage 50cloud, to name just a few common options. An adjusted trial balance provides you with the summary totals of all of your general ledger accounts after adjusting entries have been made.

We strive to empower readers with the most factual and reliable climate accounting equation information possible to help them make informed decisions. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. They have contributed to top tier financial publications, such as Reuters, Axios, Ag Funder News, Bloomberg, Marketwatch, Yahoo! Finance, and many others. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account.

Glossary Washington State Department of Health – Washington State Department of Health

Glossary Washington State Department of Health.

Posted: Thu, 17 Feb 2022 22:41:55 GMT [source]

Below is an example adjusted trial balance for Mighty Dragon! The key thing to remember is that the debits and credits must always sum to $0, and the adjusting/adjusted trial balance must also sum to $0. In the Printing Plus case, the credit side is the higher figure at $10,240. This means revenues exceed expenses, thus giving the company a net income. If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss. You want to calculate the net income and enter it onto the worksheet.

Because of the adjusting entry, they will now have a balance of $720 in the adjusted trial balance. To construct an income statement, statement of cash flow and balance sheet. Applying all of these adjusting entries turns your unadjusted trial balance into an adjusted trial balance.

At the bottom of the table, the debit and credit columns are totaled. If the totals of the two columns do not match each other, it means that there is an error. Both the unadjusted and the adjusted trial balance are listings of the ending balances of all of your general ledger accounts. Once all the accounts are posted, you have to check to see whether it is in balance. Remember that all trial balances’ debit and credits must equal.

The adjusted trial balance is completed after the adjusting entries are completed. This trial balance has the final balances in all the accounts and is used to prepare the financial statements. Companies can use a trial balance to keep track of their financial position, and so they may prepare several different types of trial balance throughout the financial year. A trial balance may contain all the major accounting items, including assets, liabilities, equity, revenues, expenses, gains, and losses. The reason for preparing the adjusted trial balance is to ensure the adjusting entries were done correctly. This is the last step before preparing financial statements that are used by you, your creditors and your shareholders to monitor the performance of your business.

Comment (0)